What is Forex?

Lesson: 1

We’re talking about forex trading, which is the process for predicting whether one currency will rise or fall in relation to another.

So, when should you buy and sell? That’s where basic analysis can help. It’s like examining the basic factors that cause money’s value to change.

Think about this: Money changes in response to economic factors such as a country’s ability to produce goods, trade, create jobs, and control interest rates.

Every piece of money belongs to a specific country. When we conduct forex basic analysis, we simply determine how a country is performing overall.

Now wake up! It’s okay if you slept through or skipped economics class. We will talk more about basic analysis later.

For the time being, pretend you know the game. Let’s learn how to trade FX.

Let’s use an example to explain how buying and selling work in forex. Assume the euro is the main player here.

So, what do you do if you believe the US economy is not doing well and the US dollar is likely to weaken? You pressed the BUY button for EUR/USD. It indicates you’re buying euros with the expectation that they’ll rise instead of the US dollar.

Okay, here’s the deal:

BUY Order (Great News for the Euro):

If you believe the US economy is not doing well and that the euro will rise against the US dollar, you should buy EUR/USD.

It’s like stating that “I want some euros because I think they will become more valuable compared to the U.S. dollar.“

SELL Order (Great News for the Dollar):

Now, if you believe the US economy is strong and the euro will fall against the US dollar, you enter a SELL order on EUR/USD.

This time, you’re saying, “I’m selling euros because I believe their value will fall relative to the US dollar.”

So, it’s similar to making predictions. If you believe the euro will rise in value, you buy it. If you believe it will fall, sell it.

Consider the US dollar as the main player in our forex scenario.

BUY Order (Dollar is Rising):

If you feel Japan wants to make their money by weakening the yen to assist their exports, you should buy USD/JPY.

It’s similar to stating, “I’m buying some U.S. dollars because I think they’ll become more valuable compared to the Japanese yen.”

SELL Order (Dollar Drops):

If you believe Japanese investors are taking money from the United States and converting it back to yen, place a SELL USD/JPY trade.

This time, you’re stating, “I’m selling US dollars because I believe they’ll lose value against the Japanese yen.”

Let’s shift our attention to the British pound, an important character in our forex journey.

BUY Order (Feeling Positive About the Pound):

If you believe the British economy is doing better than the US and will continue to grow, click the BUY button for GBP/USD.

It’s like stating, “I’m getting some pounds because I believe they will go up against the U.S. dollar.”

SELL Order (Bad News for the Pound):

Now, if you believe the British economy is showing signs of weakness but the US economy is still strong (like Chuck Norris), place a SELL GBP/USD order.

This time, you’re saying, “I’m selling pounds because I believe they’ll lose value against the US dollar.”

Let’s talk about the US dollar, which is the main character in our forex story.

BUY Order (Thinking the Swiss Franc is Too High):

If you think the Swiss currency is too expensive, click the BUY option for USD/CHF.

It’s like saying, “I’m getting some U.S. dollars because I think they will go up in value compared to the Swiss Franc.”

SELL Order (Concerns about the USD):

If you believe the US housing market is underperforming and will harm the country’s future growth, place a SELL USD/CHF order.

This time, you’re saying, “I’m selling US dollars because I believe they’ll lose value against the Swiss franc.”

Buying or selling means simply betting on whether the US dollar will rise or fall against the Swiss franc.

Imagine going to the grocery store to get an egg. You cannot buy just one egg; they are usually packed in dozens or “lots” of 12.

In the world of currency trading, buying or selling a single euro is similarly impractical. Instead, trades are often done in “lots” of 1,000 units of currency (a micro lot), 10,000 units (a mini lot), or 100,000 units (a regular lot). The specific lot size is determined by your trader and the type of account you have.

“But what if I can’t afford to buy 10,000 euros? Can I still trade?

Absolutely! You are able to do this through the use of something known as leverage.

Leverage is a useful feature that allows you to trade without having to spend the whole 10,000 euros up front. Instead, you only need to put down a tiny “deposit,” sometimes known as margin.

Simply put, leverage is the connection between the amount of your trade (known as “position size”) and the actual money you have for trading (known as “trading capital”).

For example, if your leverage is 50:1, or you demand 2% margin, you just need $2,000 to create a $100,000 account.

Margin trading allows you to open large deals with only a fraction of the money you usually need. This is how you may do transactions for $1,250 or even $50,000 with only $25 or $1,000. It allows you to make greater deals with less money at the start.

Let us break it down step by step.

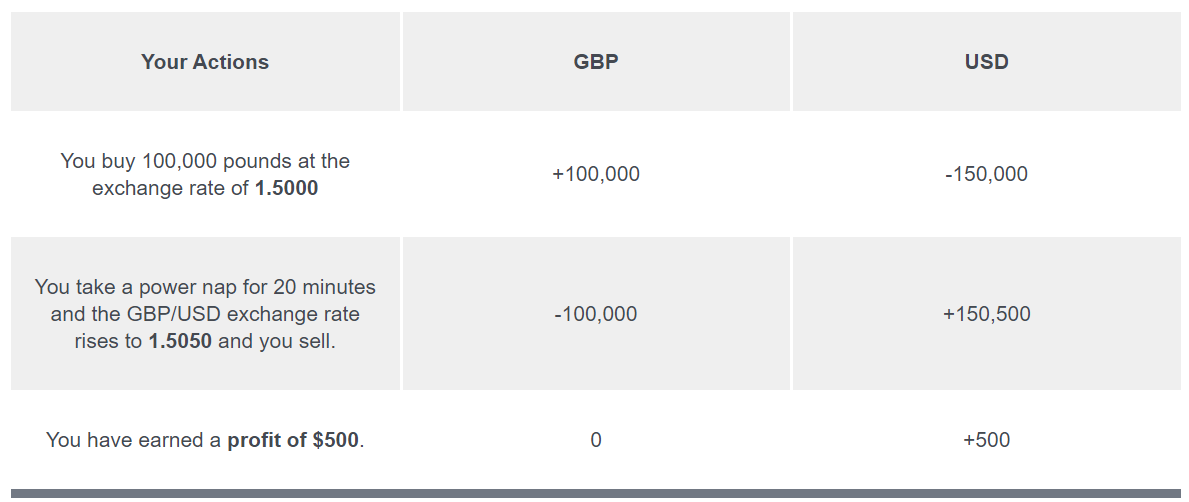

Consider you believe the British pound will rise in value against the US dollar. Got it? Good.

You now decide to make a move. You open what we call a normal lot, which is roughly 100,000 GBP/USD. Consider purchasing with the British pound, and here’s the best part, you only need a 2% margin requirement.

Here’s when things become interesting. You anxiously wait for the exchange rate to increase. When you buy that one deal for 1.50000, you are taking 100,000 pounds, which is equivalent to $150,000 (100,000 pounds multiplied by 1.50000).

Because of the 2% margin, you simply need to set up $3,000 in your account to complete this trade ($150,000 x 2%). So, for just $3,000, you can handle a stunning 100,000 pounds. Sounds exciting, right?

Now for the fun part. Your guess proved correct, so you decide to cash in. You close the sale for 1.50500, and guess what? You receive approximately $500.

That wasn’t that complicated, was it? It’s like making wise decisions with a small amount of money and turning it into something bigger. Keep it simple and smart!

When you decide to close a trade, you receive the money you started with, known as “margin.” Then we conduct some maths to determine if you made or lost money.

Now return to our GBP/USD example. The British pound increased by just half a pence, not even a whole pence. But, surprise! You earned $500!

Here’s a trick, You weren’t trading for just £1. When you first started, you took up a post for £100,000 (or $150,000). And, guess what? You only needed $3,000 to get things started. So you made $500 profit on your $3,000 investment, for a 16.67% return! And get this, it all happened in twenty minutes. Isn’t it quick and profitable?

However, keep in mind that while leveraged trading can result in large profits, it can also result in significant losses. A minor shift can result in a much larger gain or loss, so use caution. It’s like a double-sided coin!

Let’s talk about the opposite side, which isn’t so fun.

High leverage may sound interesting, but it can be quite risky.

Imagine this, You deposit $1,000 into a forex account with 100:1 leverage. This means you can control positions up to 100 times your margin (deposit), for a total control of $100,000 ($1,000 x 100). Remember, you do not directly trade the entire $100,000. The exact amount of your deposit used to keep the position is the margin requirement, which varies on several factors.

Now for the tough part. If the price moves simply 100 pips, your account has been reduced to nothing! And, just so you know, a 100-pip move is roughly €1. So you nearly cleared out your account with a one-euro pricing change. Not really cool. Take caution with that leverage!

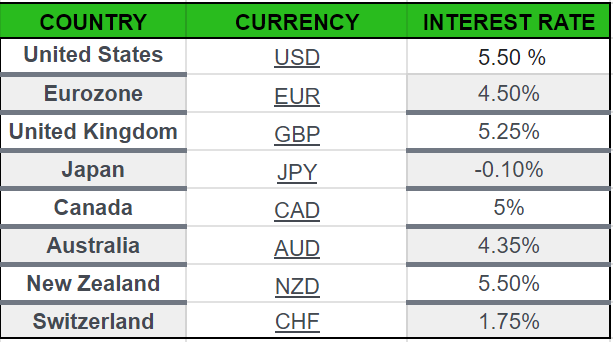

Let’s talk about something essential in forex trading: ‘Rollover.’ Around 5:00 p.m. ET, your trader announces the conclusion of the trading day, which is when the daily ‘rollover fee’ – also known as a swap fee‘ – comes in. Depending on the positions you have open, you may pay or receive this charge.

If you want to avoid dealing with interest on your trades, simply close all of your trades before 5:00 p.m. ET.

Every currency trade requires borrowing one currency to purchase another, which is where interest rollover costs come into play.

Here’s how it works, you pay interest on the currency you borrow and earn interest on the one you buy.

Central Bank Interest Rates

So, what about those interest rates we just discussed? They are similar to the strategies used by the country’s central bank for providing short-term money to its normal banks.

Here’s the exciting part, in our following lessons, we’ll show you how to take advantage of these interest rate differences.

Start free registration of forex-funded accounts

Lesson: 1

Lesson: 2

Lesson: 3

Lesson: 4

Lesson: 5

Lesson: 6

Lesson: 7

Lesson: 8

Lesson: 9

Lesson: 10

Lesson: 11

Lesson: 12

Lesson: 13

Lesson: 14

Lesson: 15

Lesson: 16

Lesson: 17

Lesson: 18

Lesson: 19

Lesson: 20

Lesson: 21

Lesson: 22

Lesson: 23

Lesson: 24

Lesson: 25

Lesson: 26

Lesson: 27

Lesson: 28

Lesson: 29

Lesson: 30

Lesson: 31

Lesson: 32

Lesson: 33

Lesson: 34

Lesson: 35

Lesson: 36

Lesson: 37

Lesson: 38

Lesson: 39

Lesson: 40

Lesson: 41

Lesson: 42

Lesson: 43

Lesson: 44