What is Forex?

Lesson: 1

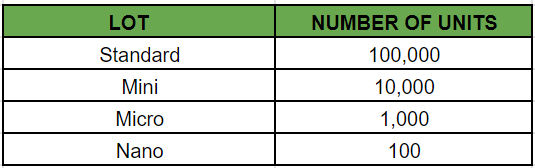

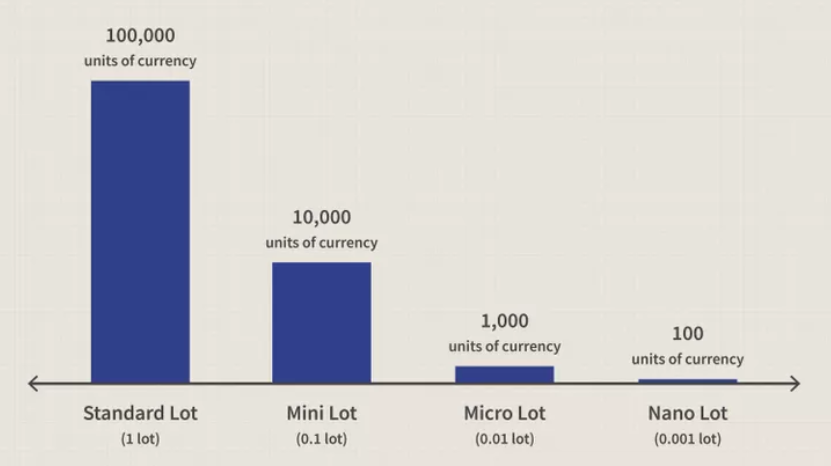

In the world of Forex, we regularly trade in fixed amounts known as lots. Think of a ‘lot’ as a unit of measurement for the quantity of dollars purchased or sold in a single transaction.

Imagine going to the grocery store to buy eggs. When you buy eggs, they usually come in a carton, right? In Forex, the process is similar, you trade in lots. A normal lot is comparable to a whole carton of eggs, which includes 100,000 units of cash.

Now here’s where things get interesting. We also provide mini, micro, and nano lots. These resemble small cartons of eggs. A mini lot is 10,000 units; a micro lot is 1,000 units and a nano lot is 100 units. So, just as choosing between a big carton and a smaller one at the supermarket, in Forex, we choose our lot size based on our trading requirements.”

Now, there’s something you should know about traders. Some traders describe quantities as ‘lots,’ while others prefer to display exact units of currency.

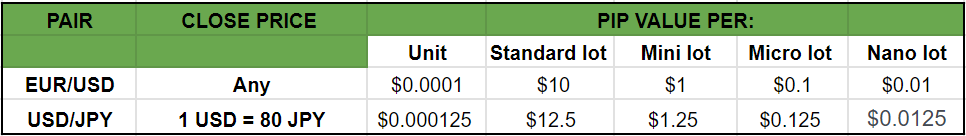

Now, let’s go into the details of currency value changes. We measure these fluctuations in ‘pips,’ which represent a very small portion of a currency unit’s value. To make a significant profit or loss on this minor change in value, you must trade bigger quantities of a given currency.

Let’s run a fast computation based on a standard lot size of 100,000 units.

For USD/JPY at an exchange rate of 119.80, it would be: (.01 / 119.80) x 100,000 = $8.34 per pip.

For USD/CHF at a rate of 1.4555, it’s (.0001 / 1.4555) x 100,000 = $6.87 per pip.

Now for a twist. If the US dollar is not the first listed currency, as in EUR/USD at a rate of 1.1930, the method alters slightly: (.0001 / 1.1930) x 100,000 = 8.38 x 1.1930 = $9.99734, which we round up to $10 per pip.

Similarly, for GBP/USD at an exchange rate of 1.8040, the calculation would be: (.0001 / 1.8040) x 100,000 = 5.54 x 1.8040 = 9.99416, rounded to $10 per pip.

Now, your trader may have a different method for calculating pip values dependent on lot size. But don’t worry, they’ll tell you what pip value the currency you’re dealing has at any given time. It’s like having a personal maths assistant!

Simply put, as the market moves, the pip value changes. So, depending on the currency you’re dealing with, the trader handles all computations for you.

Okay, let’s tackle the mystery of leverage. You could be scratching your head, wondering how a little investor like yourself can handle so much money in the forex market.

Consider your trader to be a financial buddy who gives you $100,000 to invest in the currency market. And, guess what? They just request $1,000 from you as a ‘good faith’ deposit. Sounds a little too good, doesn’t it? That’s the genius of leveraged forex trading.

Now, the amount of leverage you utilise is determined by your comfort level and your broker’s guidelines. Your trader can request a deposit, commonly known as margin.’ You can start trading once you’ve deposited your funds. Your broker will explain how much margin is required for each position (or lot) you trade.

Here is a brief example: If your authorised leverage is 100:1 (or 1% of the position necessary), and you wish to trade $100,000 but only have $5,000 in your account, don’t worry! Your trader sets aside $1,000 as a deposit and allows you to ‘borrow‘ the remainder. Any gains or losses are added or subtracted from your account balance.

At the moment, the minimum margin requirement differs among traders. In our scenario, the trader requested a 1% margin ($1,000 for every $100,000 traded). If you want to trade an average lot of USD/JPY and your account enables 100:1 leverage, you’ll need to put up $1,000 as margin. Remember that it is a deposit, not a fee, and you will receive it back when you close the trade.

Why make a deposit? When your trade is live, you may lose money. The trader requires a safety net. If your account balance goes below $1,000 due to losses, the trader will automatically close your deal to avoid further losses. It functions as a safety switch, preventing your account from going into the red.

Understanding margin trading is critical, and we’ll get more into it in a separate lesson. Trust me, it’s essential reading if you want to keep your account protected. But for now, let us move on.”

Okay, we’ve discussed pip values and leverage, now it’s time to get into the main part of profit and loss. Let us break it down.

Imagine you wish to buy US dollars and sell Swiss Francs. The rate you are quoted is 1.4525 / 1.4530. Since you’re purchasing US dollars, you’ll be dealing with the ‘ASK’ price of 1.4530, which is what traders are ready to sell at.

So you decide to purchase one ordinary lot (100,000 pieces) at 1.4530. Within a few hours, the price rose to 1.4550. You’re thinking it’s time to wrap things up.

The new USD/CHF quote is 1.4550/1.4555. Because you began the trade by purchasing, you must complete it by selling, which implies accepting the ‘BID‘ price of 1.4550 – the price at which traders are willing to buy.

Now, let’s perform some maths. The difference between 1.4530 and 1.4550 is 0.0020, or 20 pips. Remember our formula?

(.0001/1.4550) x 100,000 = $6.87 per pip. Multiply that by 20 pips, You should expect a profit of $137.40.

This is a simple overview of how to compute profit and loss in the forex game. Got it? Awesome. As we progress, we’ll look at more cases and work on improving your skills. Stay tuned!”

Okay, don’t forget about this important information while making forex moves the bid/ask spread. It is something you experience when you enter or exit a trade.

Here’s the deal: When you buy a currency, you’re looking at the ‘ASK‘ price, which is what you’ll use. When selling, however, you are more concerned with the ‘BID‘ price.

So, when you make your trades, keep an eye on the spread in the bid/ask quote. It’s similar to the handshake between buyers and sellers in the forex dance.

Start free registration of forex-funded accounts

Next, we’ll go over all of the cool forex terms you’ve learned. Stay tuned for the latest terms in the game!”

Lesson: 1

Lesson: 2

Lesson: 3

Lesson: 4

Lesson: 5

Lesson: 6

Lesson: 7

Lesson: 8

Lesson: 9

Lesson: 10

Lesson: 11

Lesson: 12

Lesson: 13

Lesson: 14

Lesson: 15

Lesson: 16

Lesson: 17

Lesson: 18

Lesson: 19

Lesson: 20

Lesson: 21

Lesson: 22

Lesson: 23

Lesson: 24

Lesson: 25

Lesson: 26

Lesson: 27

Lesson: 28

Lesson: 29

Lesson: 30

Lesson: 31

Lesson: 32

Lesson: 33

Lesson: 34

Lesson: 35

Lesson: 36

Lesson: 37

Lesson: 38

Lesson: 39

Lesson: 40

Lesson: 41

Lesson: 42

Lesson: 43

Lesson: 44