What is Forex?

Lesson: 1

Okay, now that we’ve covered what forex is, why it’s worth trading, and who participates in the forex market, let’s move on to the next important topic, when to trade.

So, while the FX market is open 24 hours a day, it is not always active.

You can profit from the market’s ups and downs. But here’s the catch, generating money becomes a big problem when the market decides to take a sleep and remain stationary.

Consider this the market becomes as peaceful as statues in Medusa’s lair. Is now not the perfect time to make a profit?

So, let’s discuss the various forex trading sessions. This step is similar to identifying the sweet spots in the day when trading is favourable.

Now, let’s discuss what happens on an average day in the forex market before going into the best trading hours.

As a result, the forex market is open around-the-clock, and it can be divided into four primary trading sessions which are Sydney, Tokyo, London, and, of course, New York, which was once the busiest period for presidential tweets (before specific events happening).

Currently, there are three peak trading sessions on the forex market historically. Rather than attempting to work around the clock, most traders concentrate on one of these three times.

We refer to it as the “forex 3-session system.” The continents or cities are the names of these sessions. We choose city names, but continents also work. There are three sessions, the Asian (Tokyo), European (London), and North American (New York) ones.

Select your preferred option in this forex game, either continent or city will function.

Let’s now discuss the International Dateline, which is the point on the calendar where a new day begins.

Fun fact, Trading begins on Monday in New Zealand, a major participant in financial concerns, when it is still Sunday for most other countries. Strangely, we still call it the Sydney session. It’s funny how regulations may be funny at times.

The currency market is open from Monday through Friday. It is not truly closed during this time. American traders close their deals between 7:00 PM and 10:00 PM GMT, during which time Kiwi and Aussie dealers start to prepare.

Weekends are great, but the currency market is only affected by two holidays: Christmas and New Year’s Day.

Take a look at the tables below. They display the start and end times of each trading session.

The timeframes I’ll show you revolve around when the forex action begins and ends. Remember that these times are determined by what is going on in the local business environment, and most businesses begin operations between 7-9 a.m. local time.

So, when we announce a session is open, it signifies that the money conversation starts. When it shuts, it’s time to end the day’s trade.

Okay, everybody, get up. The times when the FX market opens and closes sometimes confuse us, particularly in October/November and March/April. Why? Because some countries, such as the United States, the United Kingdom, and Australia, observe daylight saving time (DST).

But wait, The day a country changes to or from daylight saving time varies per country. Isn’t this confusing? Not so in Japan, which keeps things simple by not observing daylight savings time. Thanks, Japan!

Now about the Sydney Open. It may appear weird that it changes two hours in the Eastern Time Zone. Here’s the twist, when the United States moves back one hour for standard time, Sydney jumps forward by an hour. Tricky, isn’t it?

Remember this if you intend to trade at that time. Dealing with daylight saving time can be difficult, but that’s the cost of operating in a never-ending market!

Just a heads up:

The FX market will have different opening hours in March, April, October, and November. Countries play musical chairs with daylight savings time on different days.

Okay, here’s an interesting fact, between each of these forex trading sessions, there is a moment when two sessions are running continuously..

Consider this, in the summer, from 3:00-4:00 AM ET, the Tokyo and London sessions high-five each other while trading together. Also, both in the summer and winter, from 8:00 AM-12:00 PM ET, it’s like a party when the London and New York sessions hang out together.

Now, these are the busy hours of the trading day. Why? Because when two markets are open at the same time, there is a lot of activity and money moving hands.

Consider this, everyone in the market is moving and shaking things up right now.

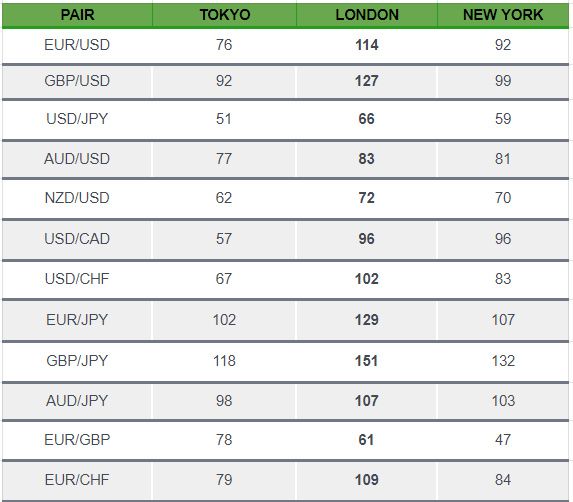

Next, let’s take a look at how much the major currency pairings change on average during each trading session.

Now, if you look at the table, you will notice something interesting, the London session is usually the most active.

Take a look at the different currency pairs and you’ll notice that some make much bigger moves (known as pip movements) than others.

Use our MarketMilk™ tool to track the real-time movement of each of the currency pairs.

For example, consider the hourly volatility for EUR/USD during the London and New York sessions:

Now, let’s look further into each trading session and look at when they overlap.

Start free registration of forex-funded accounts

Lesson: 1

Lesson: 2

Lesson: 3

Lesson: 4

Lesson: 5

Lesson: 6

Lesson: 7

Lesson: 8

Lesson: 9

Lesson: 10

Lesson: 11

Lesson: 12

Lesson: 13

Lesson: 14

Lesson: 15

Lesson: 16

Lesson: 17

Lesson: 18

Lesson: 19

Lesson: 20

Lesson: 21

Lesson: 22

Lesson: 23

Lesson: 24

Lesson: 25

Lesson: 26

Lesson: 27

Lesson: 28

Lesson: 29

Lesson: 30

Lesson: 31

Lesson: 32

Lesson: 33

Lesson: 34

Lesson: 35

Lesson: 36

Lesson: 37

Lesson: 38

Lesson: 39

Lesson: 40

Lesson: 41

Lesson: 42

Lesson: 43

Lesson: 44