What is Forex?

Lesson: 1

Hello there, fellow traders!On Sunday night at 5:00 p.m. EST (10:00 p.m. GMT), the trading day in America begins. But until Tokyo wakes up a few hours later, nothing really interesting happens.

Thus, at approximately 12:00 a.m. GMT, the Asian session officially begins, and forex trading begins.

Oh, and by the way, some people refer to it as the Tokyo session, in case you hear the term used. We have created a fantastic tool to adapt all of these trading sessions to your local time zone. Isn’t it handy? Use it till you memorise the market hours.

The third-biggest forex trading market is in Japan. Not surprisingly, considering that 16.8% of all forex transactions involve the yen, making it the third most traded currency.

Let’s discuss the Tokyo Session. Approximately 20% of all forex trading occurs during the Asian session, and Tokyo is not the only hub. Singapore and Hong Kong are also considered financial hotspots.

Here’s the kicker, trading volume in Singapore and Hong Kong now exceeds that of Tokyo. They each make up 7.6%, with Japan accounting for 4.5%.

Perhaps we should call it the “Asian session” rather than the “Tokyo session”?

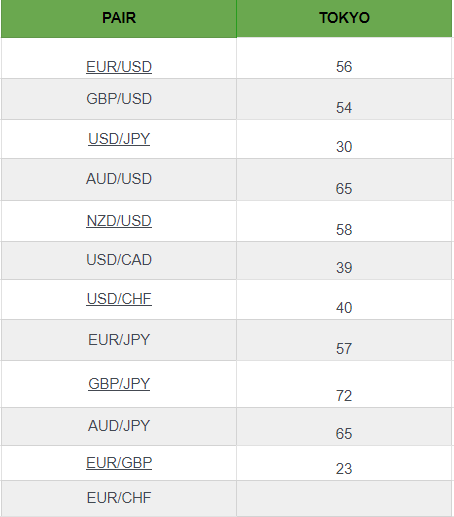

And, to keep things simple, I’ve included a table below with the pip ranges for the key currency pairs during the Asian session. Cool, right?

Now, let’s get into some pip talk. We calculated these pip values by looking at previous data averages. But keep in mind that these are not set in stone. They are subject to change depending on the market’s activity and other circumstances.

we left out the EUR/CHF session range. Why? Because the Swiss franc has been linked to the euro at 1.2000 during this period.

As an example, consider the EUR/USD average pip range.

Now, let’s discuss what makes the Tokyo session tick:

First and foremost, the action does not take place only in Japan. We have a lot of currency action going on in other great areas like Hong Kong, Singapore, and Sydney.

The major players in the Tokyo session are commercial businesses (exporters) and central banks. Japan’s economy revolves around exports, and with China involved, there are many transactions taking place on a daily basis.

But, and here’s the point, things can be slow at times. Think of it like waiting for a phone to ring, sometimes you have to wait a while.

In terms of currency pairings, the Asia-Pacific region’s equivalents, like AUD/USD and NZD/USD, usually see more swings than their non-Asia Pacific equivalents, like GBP/USD.

The real action begins early in the session, as an extensive amount of economic data is released. That’s when things become fascinating.

Oh, and get this, movements from the Tokyo session can set the tone for the entire day. Traders in the following sessions monitor what happened in Tokyo to determine their strategy.

Speaking of game plans, after some major moves in the New York session, the Tokyo session may be a little more relaxed, with some stabilisation vibes. Just something to keep in mind.

And here’s a tip, when things are slow, most partners stay to a specific range. Ideal for short-term day trades or looking for potential breakouts later in the day.

Now, let’s discuss why the Tokyo session is great for trade news:

This is when we find out what’s going on in Australia, New Zealand, and Japan, which serves as the Asia Pacific crew’s news hub.

And, guess what? If you wish to trade during major news events, now is the time to shine. Especially with yen pairings, which are the currency most commonly used by Japanese companies.

Oh, and don’t forget the big shot on the economic scene, China. When news from China breaks, things might get a little disorganised, with many ups and downs.

Here’s the twist, because Australia and Japan have economic ties with China, any news from China can cause the Australian dollar (AUD) and Japanese yen (JPY) to rise.

So, be alert during this session, especially if the news is booming.

Ready for the next chapter? We’re about to go into the London session. There will be some exciting developments ahead!

Lesson: 1

Lesson: 2

Lesson: 3

Lesson: 4

Lesson: 5

Lesson: 6

Lesson: 7

Lesson: 8

Lesson: 9

Lesson: 10

Lesson: 11

Lesson: 12

Lesson: 13

Lesson: 14

Lesson: 15

Lesson: 16

Lesson: 17

Lesson: 18

Lesson: 19

Lesson: 20

Lesson: 21

Lesson: 22

Lesson: 23

Lesson: 24

Lesson: 25

Lesson: 26

Lesson: 27

Lesson: 28

Lesson: 29

Lesson: 30

Lesson: 31

Lesson: 32

Lesson: 33

Lesson: 34

Lesson: 35

Lesson: 36

Lesson: 37

Lesson: 38

Lesson: 39

Lesson: 40

Lesson: 41

Lesson: 42

Lesson: 43

Lesson: 44