What is Forex?

Lesson: 1

Having viewed the big picture of the forex market, let’s go a little deeper and learn more about the players.

It’s critical to understand what the spot forex market is about and who the major players are.

So, who is playing the forex game? Let’s find out, from expensive banks to ordinary people relaxing at home in their sleepwear.

Back in the late 1990s, only the “big shots” could participate. You required ten to fifty million dollars just to get started. That sounds like a lot, right?

Originally, forex was created for bankers and large corporations, not average people.

However, since the internet has grown in popularity, online forex brokers may now provide trading accounts to “everyday” traders like us.

No more waiting, let’s meet the main forex players:

Now, let’s talk about the major participants in the forex trading business: commercial banks and fancy financial institutions. These are the people who actually make things happen.

In the unpredictable world of FX, these massive institutions determine how much your money is worth.

They handle the majority of the trading action every day, making money as market participants.

Similar to a high-stakes game, these organisations have the resources and expertise to maintain calmness.

Every day, these big banks, commonly known as the interbank market or interdealer market (or as I like to call them, “flow monsters“), handle an incredible amount of FX transactions. What’s their job? Pick up their share of the forex trading action.

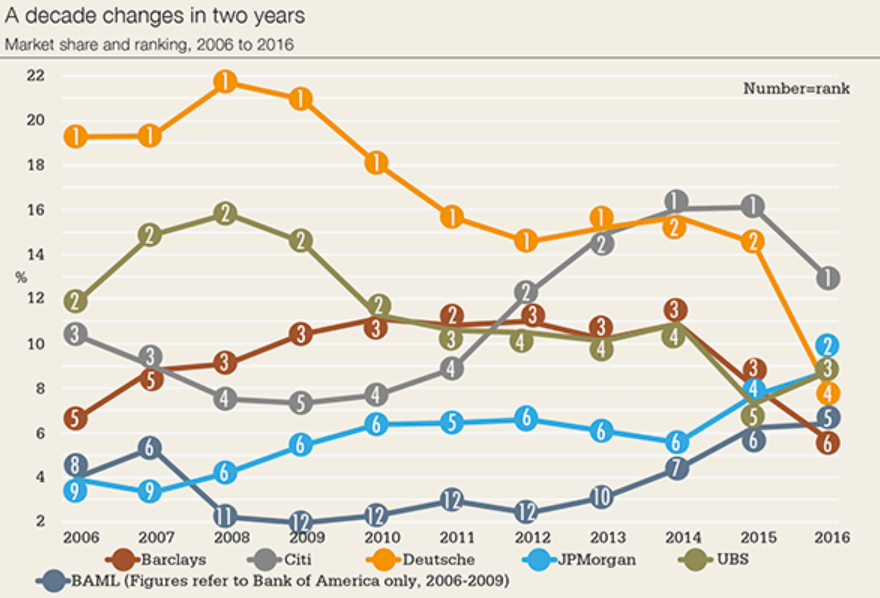

Let me give you some names: Citi, JPMorgan, UBS, Barclays, Deutsche Bank, Goldman Sachs, HSBC, and Bank of America. They are the genuine thing in the currency business.

Now, let’s talk about Electronic Liquidity Providers (ELPs), the skilled technology professionals who’ve risen to popularity in the foreign exchange (FX) industry. How? They’re magicians with advanced tools and super-smart trading strategies who are here to ensure that the market has enough liquidity for everyone.

Get to know some of the hippest ELPs (Electronic Liquidity Providers) around: XTX Markets, Virtu Financial, Citadel Securities, Flow Traders, HC Tech, and Jump Trading.

Consider them the currency market’s middlemen, constantly quoting prices for various currencies. Their job is to make it easier for buyers and sellers to meet each other, which speeds up transactions and lessens the shocks that come from a disorganised market.

Let’s discuss why businesses enter the foreign currency market, it’s all part of running a business.

Consider Apple as an example. They must exchange their US dollars for Japanese yen in order to purchase electronic parts from Japan. And who gives them a helping hand? They turn to commercial banks first.

Even while small businesses don’t have the same financial resources as those large banks, they are still quite important. The world of currencies can be affected when large corporations merge or acquire one another. A large exchange of money might cause prices to fluctuate.

Therefore, companies are important participants even though they may not have the glamorous reputation of large banks. International firms have to manage currencies to pay for goods and services, protect themselves from currency fluctuations, and manage their cash flow.

Even while they may not be as profit-driven as the major companies, their currency decisions have the ability to significantly impact the market.

Let us now study the universe of national banks and government-owned administrations, focusing on the key players functioning in the background.

Countries, such as the Central Bank, the Bank of Britain, and the European National Bank, are normal participants of the unknown trade market. They are involved because it will help them with their day-to-day operations, new trade exchanges, and new trade boards.

Consider national banks to be their own puppeteers, managing a foreign trade market.

These significant individuals are responsible for developing policies (financial plans) that have the potential to move monetary values. They are in charge of adjusting loan interest rates and managing the amount of funds available for utilisation.

They can make a lot of money by playing with these gadgets.

Furthermore, these national banks occasionally intervene in trade rate movements, either directly or indirectly. When they believe their money is abnormally high or excessively low, they pull out all the stops, trading large amounts of it to modify the numbers.

When these national banks take action, you best accept that everyone is watching them.

In this regard, let us go into the universe of money theory. It’s similar to buying and holding unknown cash in the hopes of selling it at a higher price later. It is not the same as when people buy cash for investment purposes or to buy goods from other countries.

Remember the expression, “Not fooling around!” That is the soul of examiners, the ones who try to make a profit by trading money. They keep an eye on expenses in an effort to predict increases or decreases.

Why is it called theory? Indeed, this is due to the lack of clarity surrounding the situation. Nobody should be confident that a cash’s value would rise or decrease. Brokers, the ones who make the decisions, evaluate all possibilities before making an exchange.

In the currency market, examiners account for around 90% of all trading. They come in a variety of forms, some have a lot of money, while others do not, but they are all here to make money.

For this case, let us focus on two types of examiners:

These are the players in the game being investigated.

Now, let us discuss two major organisations in the forex market

These people are like trade magicians. They use advanced strategies and modern technology to predict currency movements. Risk-taking is their game, and they often utilise a technique known as leverage to increase the amount they bet.

On the other side, we have retail traders, ordinary individuals like you and me with huge ideas. Individuals trade currencies using their personal computers, smartphones, or tablets. They may not have the flashy tools of the big guns, but thanks to online platforms and instructional materials, they are becoming more important in the forex market.

Retail traders are various, including those who trade for fun to those who want to trade full-time. They might not have a similar market influence as the large monsters, yet they are a significant part of the forex business.So, in the FX market, you have everyone from big central banks to ordinary people, each with their own objectives and methods. It’s like a large, diverse family that contributes to the World currency market.

Lesson: 1

Lesson: 2

Lesson: 3

Lesson: 4

Lesson: 5

Lesson: 6

Lesson: 7

Lesson: 8

Lesson: 9

Lesson: 10

Lesson: 11

Lesson: 12

Lesson: 13

Lesson: 14

Lesson: 15

Lesson: 16

Lesson: 17

Lesson: 18

Lesson: 19

Lesson: 20

Lesson: 21

Lesson: 22

Lesson: 23

Lesson: 24

Lesson: 25

Lesson: 26

Lesson: 27

Lesson: 28

Lesson: 29

Lesson: 30

Lesson: 31

Lesson: 32

Lesson: 33

Lesson: 34

Lesson: 35

Lesson: 36

Lesson: 37

Lesson: 38

Lesson: 39

Lesson: 40

Lesson: 41

Lesson: 42

Lesson: 43

Lesson: 44