What is Forex?

Lesson: 1

Hello, future Forex experts! Today, we’ll look at orders in the Forex market. Imagine you’re in a cafe, not for coffee, but to trade pips!

Now, a Forex order isn’t like an ordinary coffee order. It’s similar to submitting a request to your broker using their trading platform to start or complete a transaction when certain circumstances are met.

So let’s break it down. An ‘order‘ simply indicates whether you want to enter or exit a trade.

In the Forex market, there are various types of orders, and it is critical to understand what your trader takes. They differ from trader to trader.

We have two major buckets for orders:

Now, let’s make a quick map to help us move from the many types of orders within each bucket.

Okay, let’s understand market orders. Consider ordering your favourite items online. It’s quick and easy.

A market order is when you wish to buy or sell immediately at the best available price. Picture this, The bid and ask prices for EUR/USD are 1.2140 and 1.2142, respectively.

If you decide to buy in the market, you will pay the asking amount of 1.2142. Click ‘purchase,’ and bang! Your trading platform makes it happen in an instant. It’s similar to Amazon’s 1 Click ordering process, you see the price, click, and it’s yours!

Now here’s the twist, instead of receiving a Justin Bieber CD, you’re exchanging one money for another. But, well, the basic idea remains the same. Quick and simple.

The price you see and the final execution price on your platform may fluctuate a bit due to market conditions. But that’s the deal in the exciting world of forex trading!”

Alright, let’s speak about another essential Forex concept, the Limit Order. It’s similar to setting a shopping budget before going to the mall.

So, a Limit Order is when you decide to buy below the current market price or sell above it at a price that has been set, known as the ‘limit price.’

Here is the deal

Buy Limit Order: You use this to buy at or below a specific price.

This is for selling at a specific price or better.

Now, when the market reaches that ‘limit price,’ your order is activated and executed at that price or, preferably, better.

Check out this image, with the blue dot representing the current price. Do you see the green line below? If you place a BUY limit order there, it will only be activated when the price decreases.

Look at the red line above. If you place a SELL limit order there, it will wait until the price rises to that level.

For example, suppose EUR/USD is at 1.2050 and you want to sell when it reaches 1.2070. You could either wait in front of your screen or place a sell limit order at 1.2070 and go to your ballroom dance class. If it reaches 1.2070, your platform will handle the selling for you.

So, why use it? It’s similar to expecting a price change. A Buy Limit allows you to enter at or below your given price, while a Sell Limit allows you to exit at or above your specified price.

Now, isn’t that similar to creating a purchasing budget and waiting for the perfect sale? Forex is in fact similar!”

Let’s understand Stop Orders, the stop that pauses the execution of an order until the price reaches a specified point.

Stop Entry Order: This is used when you want to buy above or sell below the market at a set price.

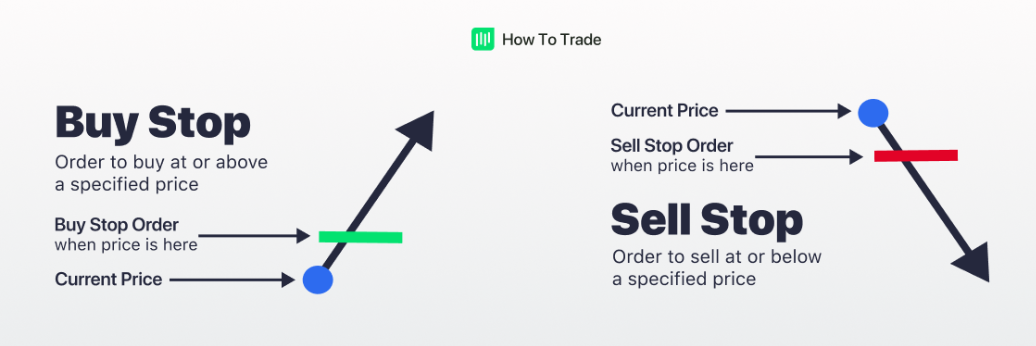

Place a ‘Buy Stop‘ order to purchase when the price exceeds the current market price. It happens when the market price reaches or crosses the Buy Stop price.

Create a ‘Sell Stop‘ order to sell when a certain price is met.

Now, observe the green line above the blue dot, which represents the current price. If you place a BUY stop order there, it will only be executed if the current price continues to rise. If the red line is below, a SELL stop order will be activated if the current price continues to decrease.

So, a stop order activates when the price becomes less favourable to you.

Let’s imagine the GBP/USD is at 1.5050 and rising. You believe it will continue to rise once it reaches 1.5060.

So, here’s your move

Sit at your computer and buy when the market reaches 1.5060, OR

Set a stop entry order at 1.5060. If it gets there, your platform takes care of the purchasing for you.

It’s like adding a safety net to your trade in case the market takes a different direction. That is the power of Stop Orders!”

All right, everyone, let’s talk about an essential tool in the trading game, the Stop Loss Order. Consider it your safety net, preventing you from suffering a significant loss if the market does not cooperate.

Remember this one, everyone!

Your stop loss order remains active until your trade is closed out or you cancel it. Now here’s where things get interesting.

Assume you went long EUR/USD at 1.2230, but to be careful, you placed a stop loss order at 1.2200. This means that if the EUR/USD falls below 1.2200, your platform will immediately sell at the best available price, reducing your loss to 30 pips. Not ideal, but preferable to a serious disaster!

What Are the Advantages of Stop losses? You don’t have to stay glued to the screen all day. Set it and forget it, then go enjoy your basket weaving class or that exciting elephant polo game. It’s like having.

Okay, friends, it’s time to find out the amazing benefits of Trailing Stops. It’s like having a dynamic safety net around your trades.

This is a stop loss order that is permanently attached to your open trade, but here’s the clever part, it moves automatically when your profit reaches an amount that you specify.

Consider this, you decide to short USD/JPY at 90.80 with a trailing stop of 20 pips.

Your initial stop loss is set at $91.00. If the price falls and reaches 90.60, your trailing stop will move down to 90.80 (or breakeven). one, and this is a huge one, the new stop level remains fixed. It will not spread, even if the market tries to fool you.

Let’s go deeper into the example with a trailing stop of 20 pips, if USD/JPY reaches 90.40, your stop would move to 90.60, resulting in a tasty 20 pips profit.

Your trade remains active as long as the price does not move against you by 20 pips. But here’s the kicker after the market reaches your trailing stop price, a market order quickly closes your position at the best possible price.

It’s like having a smart assistant alter your safety net to ensure you lock in earnings while avoiding potential losses. Trailing stops the risk management superheroes.

All right, let’s handle a major zone of confusion for newcomer traders, Limit Orders vs. Stop Orders. It’s like knowing two separate instruments in your trading tool kit.

Similarities: Both orders require setting a cost, allowing you to inform your broker once you need to move within the market.

Differences: Typically where things get interesting.

It goes into activity when the market price comes to or exceeds a predetermined stop cost.

In case, on the off chance that the EUR/USD is at 1.1000 and you put a stop entry order to purchase at 1.1010, your order will be executed when the cost comes to that level.

In any case, be prepared for a surprise, you may well be filled at the stop cost, marginally more awful, or much better. It all depends on how unusual the market is when it comes to your stop cost. It’s comparable to setting an upper limit, and the genuine execution cost shifts with market conditions.

This one can as it were done at a cost break even with to or higher than your set limit cost.

For example, in case EUR/USD is exchanging at 1.1000 and you put a limit entry order to purchase at 1.1009, your arrangement will hold tight until it is filled at 1.1009 or something better.

Consider your limit cost to be a cost guarantee, it’ll as it were executed on the off chance that the cost is met or exceeded.

But here’s the capture, the market may never reach your limit cost. So, even on the off chance that you expect to go long on EUR/USD, your arrangement may never be executed in case the market chooses to take after a different way. It’s a bit of a chance, you’ll miss out on a growing market.

So, what’s the tradeoff? A limit order gives you control over your entry cost, but the advert may not play along. It’s like choosing between tolerance and losing out on the action. Tough choices within the trade game.

Time to take a look at some unique orders in the Forex world, not like your normal coffee order, but near!

This order is just like the Energizer Bunny, it proceeds until you choose to stop it. Your trader will not interfere. So, in case you put a GTC, keep in mind that it is your duty to cancel it when essential.

Usually like a one-day pass. Your order is live until the conclusion of the trading day, for the most part around 5:00 p.m. EST. But, keep in mind, Forex could be a 24-hour party, so check along with your broker for the specific closing time.

These are referred to as ‘time in force’ orders. It’s like giving your order a timeline how long it’s permitted to party before calling it a day.

Imagine placing two orders at the same time, but one of them is captured and executed. It’s like requesting two dishes but just selecting one when the server arrives.

For example, if EUR/USD is at 1.2040, you may need to buy at 1.2095 if it breaks a resistance level or sell if it falls below 1.1985. OCO guarantees at least one of these orders will be served, preferably the first one that arrives.

This one works in sets. When your initial arrangement is engaged, you set up an OTO to initiate profit-taking and stop-loss levels.

Assume USD/CHF is at 1.2000 and you expect it to reach 1.2100 before falling back to 1.1900. You went to a basket weaving competition on Mt. Fuji (no internet there). So, you establish an offer limit of 1.2000 while also setting a related purchase restriction of 1.1900 and a stop-loss of 1.2100, both of which will be activated if your first offer order of 1.2000 goes live.

These are known as conditional orders, they function similarly to backup plans but with specific criteria attached.

So there you have it, an insight into the world of unusual Forex orders. It’s like adding a little creativity and technique to your transaction.

So, to summarise, let’s keep to the essentials of Forex orders:

market, limit entry, stop entry, stop loss, and trailing stop. Most traders rely on these instruments as part of their toolkit.

Currently, when you’re seeking to get into the action, consider these outstanding orders:

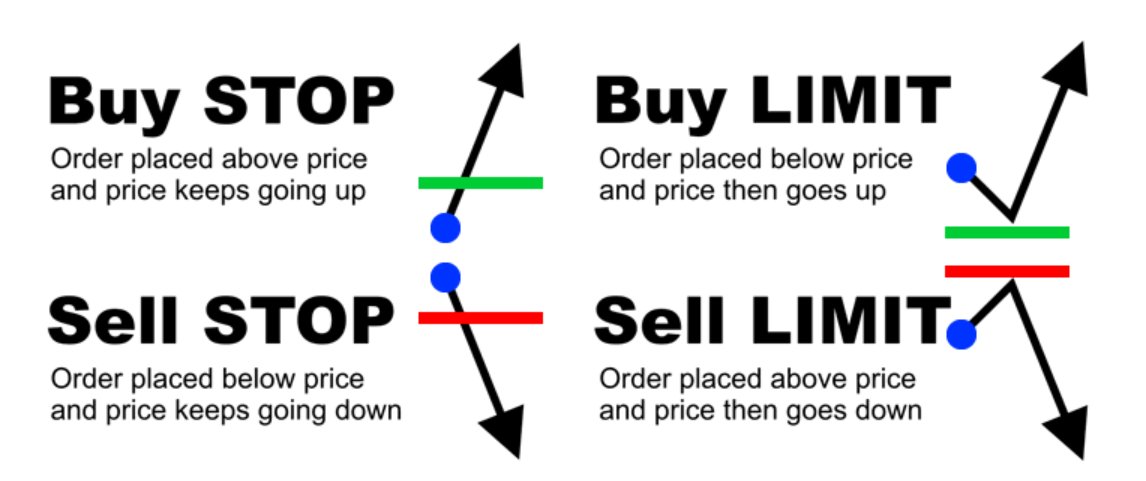

‘Buy stop‘ means going long at a higher cost than the current one.

‘Sell stop‘ to go brief for a lower price than the present one.

‘Buy Limit‘ allows you to go long at a lower cost than the current one.

‘Sell Limit‘ allows you to go brief at a higher price than the current one.

Here’s a quick cheat sheet with the blue spot representing the current cost.

Currently, unless you are an experienced trader (don’t worry, you’ll get there with practice), don’t complicate things by placing a lot of orders in the market all the time.

Choosing between a limit order and a market order is like deciding between instant gratification and saving a few dollars. If you need to buy ‘right now,‘ you place a market order and pay the higher asking price. If you are silent and want to save money, use a limit order.

However, there are certain limitations to tolerance. Sometimes the price continues to rise, and your limit order remains unfulfilled. If you still want in, you can end up paying more than the initial ask.

So, start with the basics, get comfortable with your broker’s system, and don’t invest real money unless you’re entirely comfortable. Keep in mind that market orders are like wild cards, with no set pricing, but limit orders give you greater control over how much you’re willing to pay.

And one final bit of advice, do not trade with real money until you have mastered your trading level. Mistakes happen more often than you realise! Keep it simple, sharp, and cheerful trading.

Start free registration of forex-funded accounts

Lesson: 1

Lesson: 2

Lesson: 3

Lesson: 4

Lesson: 5

Lesson: 6

Lesson: 7

Lesson: 8

Lesson: 9

Lesson: 10

Lesson: 11

Lesson: 12

Lesson: 13

Lesson: 14

Lesson: 15

Lesson: 16

Lesson: 17

Lesson: 18

Lesson: 19

Lesson: 20

Lesson: 21

Lesson: 22

Lesson: 23

Lesson: 24

Lesson: 25

Lesson: 26

Lesson: 27

Lesson: 28

Lesson: 29

Lesson: 30

Lesson: 31

Lesson: 32

Lesson: 33

Lesson: 34

Lesson: 35

Lesson: 36

Lesson: 37

Lesson: 38

Lesson: 39

Lesson: 40

Lesson: 41

Lesson: 42

Lesson: 43

Lesson: 44