What is Forex?

Lesson: 1

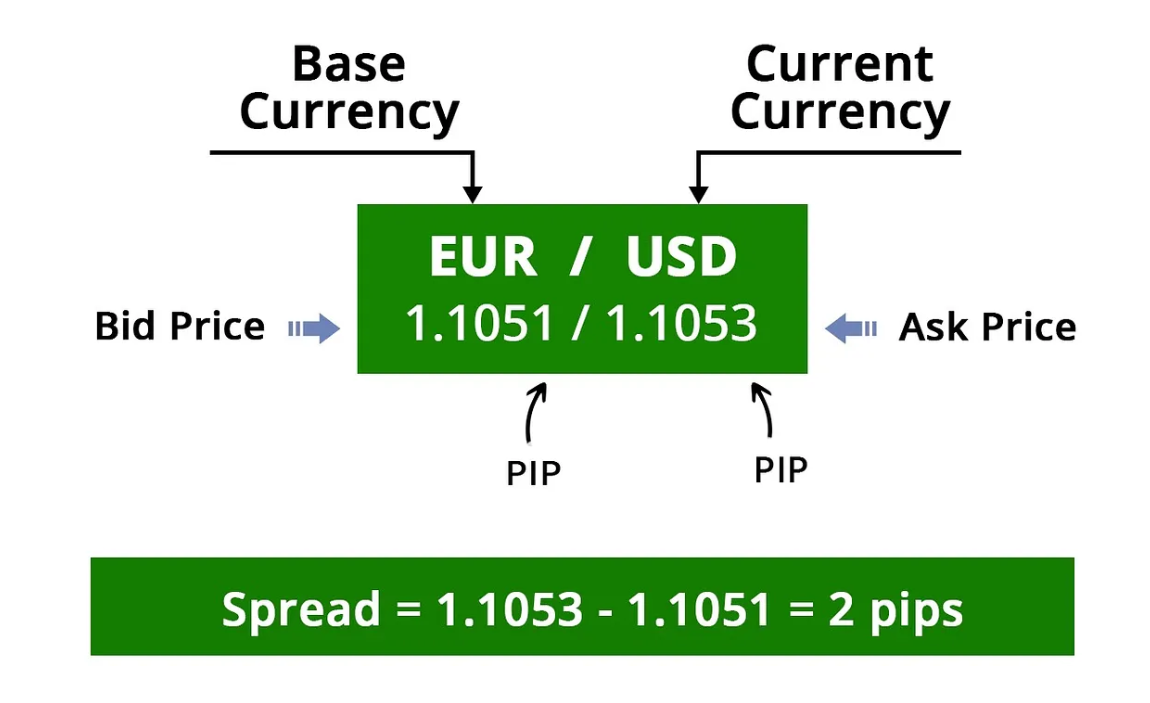

Okay, let’s talk about spreads in Forex trading. When working with Forex traders, you will be offered with two prices: the bid price and the ask price.

The “bid” is the price you want to sell the base currency, and the “ask” is the price you want to purchase it at. The spread is the difference between these two prices, often known as the “bid/ask spread.”

So, why should this matter? Well, this spread is how traders who advertise “no commission” make their money. It’s like a small fee for completing your transactions quickly. We may use the words “transaction cost” and “bid-ask spread” alike.

Instead of charging you a separate fee for each trade, they secretly include the cost in the purchase and sell prices of the currency pair you’re interested in.

Consider this: pretend you’re selling your old iPhone at a retailer. The store wants to make some money, right? As a result, it must purchase your iPhone at a lower price than it intends to sell it for. The spread is the difference between what they pay you and what they expect to make selling it.

The same goes with Forex. The traders sell the currency to you for a bit more than they paid for it, and when they buy it back from you, they try to pay a little less than they’ll earn when they sell it. The difference, my friends, is the Forex spread.

Here’s the thing about traders claiming “zero commissions“: it’s a little sneaky. Yes, they may not charge a separate commission fee, but you will still pay a commission. It’s only hidden within the bid/ask spread! Sneaky, right? Okay, keep that in mind as you enter the world of Forex trading.

Okay, let’s discuss how we measure spreads in Forex trading. It is typically done in “pips,” which are the smallest changes in the price of a currency pair.

In most currency pairs, one pip equals 0.0001. So, if you see a 2 pip spread for EUR/USD, it will look as 1.1051/1.1053. That is how we determine the difference between purchasing and selling prices. Simple, right? Pips are like small steps in the movement of money.

When it comes to currency pairs with the Japanese yen, we normally get quotes with only two decimal places, unless we’re dealing with fractional pips, in which case there are three decimals.

Consider USD/JPY, for example. A quote might appear as 110.00/110.04. This suggests there’s a 4-pip gap between the purchasing and selling prices. It’s similar to measuring the distance between two points on a map, except in the world of currencies!

Alright, let’s talk about the many sorts of spreads you’ll come across in Forex. The types of spreads you see on a trading platform are determined by the forex trader and how they generate money.

There are essentially two types:

That is it! It’s like selecting between two flavours of ice cream: fixed and variable spreads. Keep that in mind as you go into the forex business!

Okay, let’s look at the different types of traders and the spreads they offer. Traders who work under the “market maker” or “dealing desk” model normally use fixed spreads. Variable spreads are preferred by traders with a “non-dealing desk” strategy.

So it’s like deciding on your play style, fixed if you want a set deal, variable if you want some flexibility. Keep that in your toolset while you study the Forex market!

Let us discuss fixed spreads in forex. These spreads remain constant regardless of whether the market is extremely busy or very calm.

Fixed spreads are now offered by traders who operate under the “market maker” or “dealing desk” model. Consider this, the trader buys large portions of inventory from other major players and then sells smaller parts to us.

Because the broker is like a dancing partner in our trades, they can keep these spreads consistent. It’s as if they’re playing the music, and it doesn’t matter whether the party is exciting or relaxed; the beat remains constant.

Let’s understand why trading with Fixed Spreads is beneficial. First, you don’t need much money to get started, it’s a low-cost choice.

And when you trade with set spreads, calculating how much you’re paying is simple. Why? Because costs never change. It’s similar to knowing the price before ordering something, no surprises, simply clear and easy to understand.

Now, let’s discuss the disadvantages of trading with fixed spreads. Consider this, you may have heard of “requotes,” which is kind of like how often you see the Kardashian sisters’ postings on Instagram.

Fixed spreads might be difficult to use when the market is unpredictable. Your broker, who tells you the pricing, cannot change them quickly. So, if you try to make a move at a specific price, they may reply, “Wait, things have changed – do you still want in?” But here’s the catch, the new pricing is rarely as good as the original. Is this not cool?

There’s also something called “slippage.” It’s similar to when you believe someone on Tinder looks one way but they appear completely different in person. When trading moves quickly, the broker may fail to keep to the stated fixed spread. As a result, the final price may fluctuate significantly from what you expected.

So keep a watch out for requotes and slippages, which are like unanticipated twists in the trading plot. Just something to remember while you explore the world of forex!

Let’s talk about something essential in forex: variable spreads.

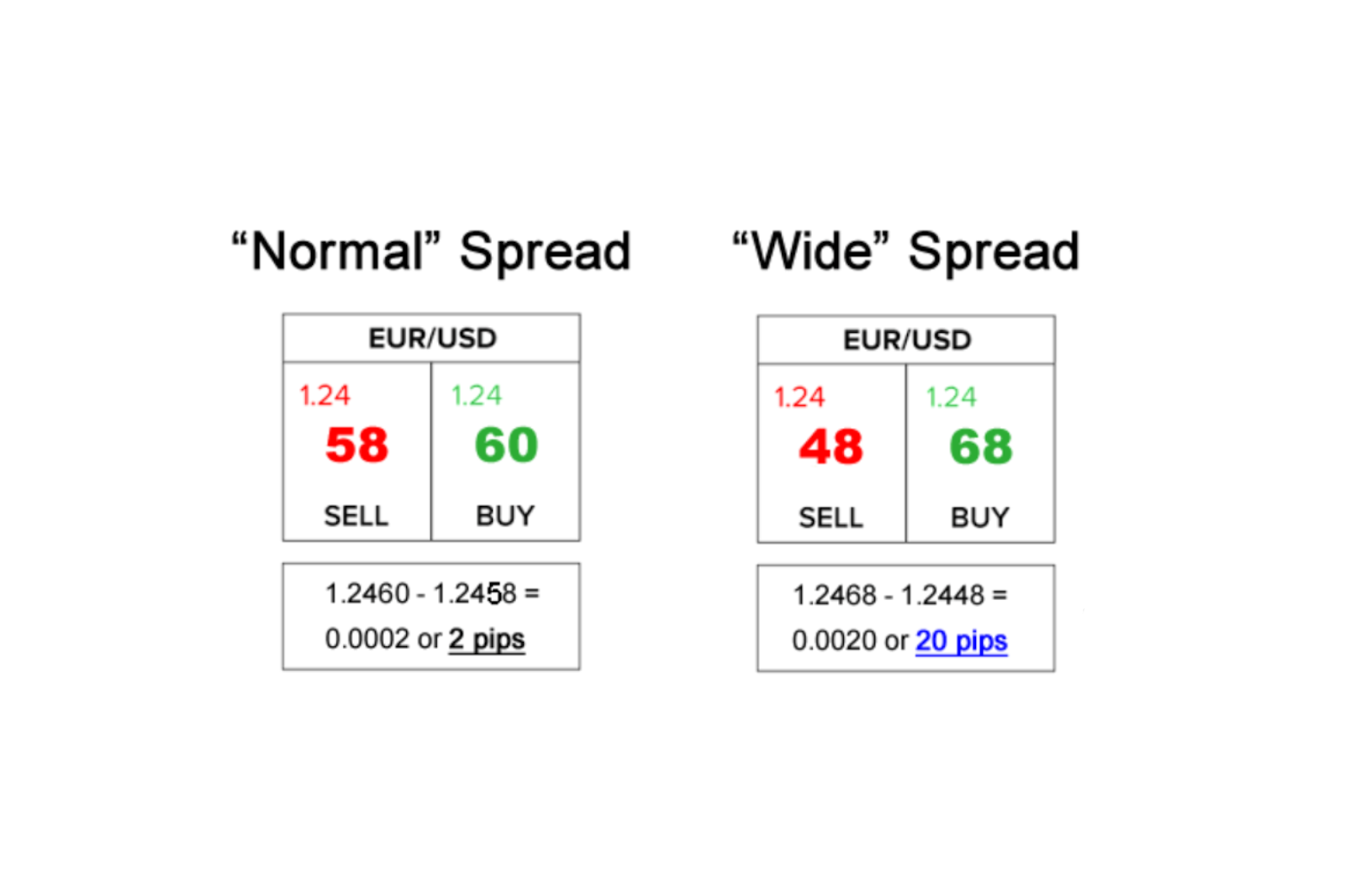

So, what are variable spreads? As the name implies, they are constantly changing. When dealing with changing spreads, the difference between the purchasing and selling prices of currency pairs never remains constant.

These variable spreads are usually offered by non-dealing desk traders. What differentiates them is that they obtain currency pair values from a variety of sources and distribute them to traders without the involvement of a dealing desk. Simply put, they do not control the spreads. The width of the spread, whether it widens or narrows, is determined by how many individuals want to buy or sell a currency and how unpredictable the market is.

Imagine you’re ready to buy EURUSD with a spread of 2 pips. But then, right when you’re about to make your move, BOOM! The US unemployment report is released, and the spread immediately expands from 2 pips to a huge 20 pips! That’s how variable spreads work.

Let’s speak about the benefits of trading with variable spreads. It’s like taking a break from some common worries.

First, there’s no need to worry about “requotes” anymore! Variable spreads adjust to market conditions, so you’re fine there.

But wait a second! While “requotes” are no longer in use, you may encounter something known as “slippage.” This is when the price you receive after executing a trade does not exactly meet your expectations.

So, why should you be satisfied trading with changing spreads? Well, it adds greater transparency to the game. How? These traders collect pricing from several sources, which creates some competition. And, guess what? Competition generally equals better costs for you! It’s like having more selections at a buffet, you may choose what suits you best.

So, trading with changeable spreads not only reduces some worries, but also provides a better understanding of what you’re paying for in the currency market. It’s like having a lot of options, making your trading experience more simple and adaptable.

Let’s discuss the disadvantages of trading using Variable Spreads. There are a handful of disadvantages to be aware of.

First and foremost, fluctuating spreads may not be the greatest option for scalpers. Wider gaps can eat away earnings quickly, making them unsuitable for quick, modest trades.

There’s also some bad news for news traders. The spread may widen so greatly that what appears to be a profitable move can quickly become unprofitable. It’s as if the market is playing tricks on you, especially around major news events.

It depends on what the trader needs.

Some traders may prefer fixed spreads to variable spreads, but others may feel the reverse. Fixed spreads may be preferable if you have a small account and do not trade frequently.

On the other hand, if you deal with a larger account and are an active trader, particularly during peak market hours when spreads are most narrow, variable spreads may be more advantageous.

Something to consider: If you want your trades to be executed quickly and without requotes, variable spreads could be the way to go. It all comes down to determining which option best suits your trading style and demands.

Now that we’ve looked over what a spread is and the two types (fixed and variable), let’s get into something essential.

We’ll discuss how the spread is related to the actual costs of completing a trade. It’s actually quite easy to figure out, because all you need are two things:

Let me explain with an example….

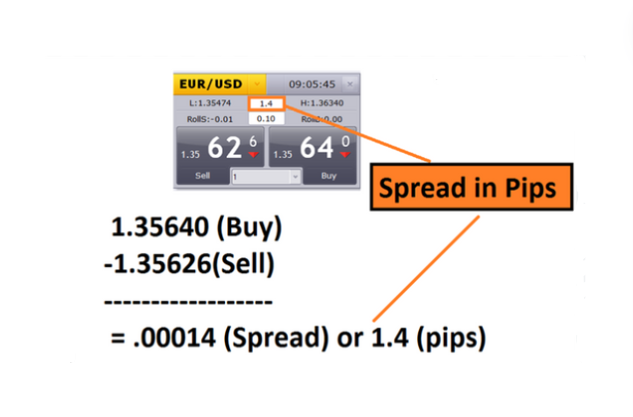

Consider this You can purchase EURUSD at 1.35640 and sell it at 1.35626.

If you buy and then sell soon, you will lose 1.4 pips. To find the cost, simply perform two things:

To get the cost per pip, multiply $1 by the number of lots being traded.

So, if you’re trading small lots (10,000 units), the total cost to start this trade is $1.40. That is what you are paying.

Keep in mind the pip cost as an easier way. Simply multiply the cost per pip by the number of lots traded, as if you were connecting the dots.

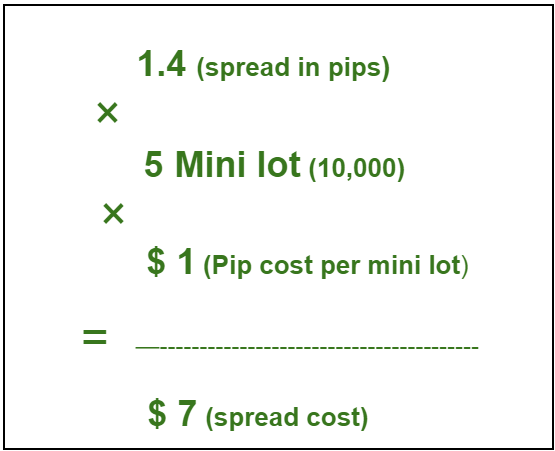

Here’s the twist, if you decide to trade more, your overall cost, as reflected in the spread, increases. Let me give you an example. If the spread is 1.4 pips and you trade 5 mini lots, the total cost will be $7.00. That is what you will spend.

Start free registration of forex-funded accounts

Lesson: 1

Lesson: 2

Lesson: 3

Lesson: 4

Lesson: 5

Lesson: 6

Lesson: 7

Lesson: 8

Lesson: 9

Lesson: 10

Lesson: 11

Lesson: 12

Lesson: 13

Lesson: 14

Lesson: 15

Lesson: 16

Lesson: 17

Lesson: 18

Lesson: 19

Lesson: 20

Lesson: 21

Lesson: 22

Lesson: 23

Lesson: 24

Lesson: 25

Lesson: 26

Lesson: 27

Lesson: 28

Lesson: 29

Lesson: 30

Lesson: 31

Lesson: 32

Lesson: 33

Lesson: 34

Lesson: 35

Lesson: 36

Lesson: 37

Lesson: 38

Lesson: 39

Lesson: 40

Lesson: 41

Lesson: 42

Lesson: 43

Lesson: 44