What is Forex?

Lesson: 1

Okay, everyone, let’s explore the forex market and learn how the markets move. Imagine this, our friends in Europe are getting ready for a day in the forex market while our colleagues in Asia are finishing up their workday.

London is one of the most notable financial centres in Europe today. Because of its advantageous location, it has long been an economic hub. London is unique since its morning falls on the end of Asia’s trading day, and its afternoon falls on the busiest time of day in New York City.

For this reason, London is referred to as the forex capital, as 43% of all currency transactions take place here, with trades happening every single minute.

Considering that other significant financial hubs like Geneva, Frankfurt, Zurich, and more are also open for business, some traders refer to this trading session as the “European” one.

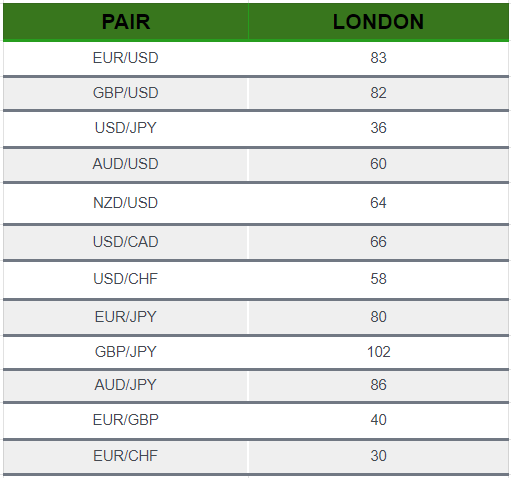

Have a look at this helpful table that displays the pip ranges for the main currency pairings throughout London sessions.

Now, let’s discuss the pip values. We discovered them by looking at previous data averages. But this is the point they’re not set in stone. Actual numbers can fluctuate depending on market activity and other factors.

We did not include the EUR/CHF session range. Why? At the time, the Swiss franc was closely tied to the euro at 1.2000.

Here’s some interesting details regarding the European session:

So, because London’s session overlaps with the other major trading sessions, and London is a financial powerhouse, a lot of forex action takes place during this time. This implies a high volume of trade, which might reduce transaction costs by increasing market liquidity and, you know, lowering pip spreads.

Because of the high volume of transactions, the London session is often highly unpredictable.

Here’s a fascinating fact, many trends start in London and typically continue until the New York session begins.

But wait, things calm down a little in the midst of the session. Traders take a lunch break, preparing for the New York market rush.

Watch careful, since trends may perform a little dance at the end of the London session. European traders may decide it’s time to lock in some profits, changing the script slightly.

Now, let’s look into the action during the European session. It’s a busy time with lots of transactions, so practically every pair is fair game for trading.

However, if you want to play it safe, sticking with the major players such as EUR/USD, GBP/USD, USD/JPY, and USD/CHF is a good idea. These people normally have the tightest spreads, which means less headache for you.

Keep your ears open for any news headlines during the European session, since these prominent pairs tend to dance to that tune.

Are you up for a little exploration? Try trading yen crosses such as GBP/JPY and EUR/JPY. As they are cross pairings, the spreads may be slightly wider, which makes them somewhat unexpected.

Moving on, let’s talk about the New York session. It resembles a jungle where trading fantasies come true. Regarding dreams, have you ever heard the song by Alicia Keys? This session, however, has a rhythm and vibe of its own.

Lesson: 1

Lesson: 2

Lesson: 3

Lesson: 4

Lesson: 5

Lesson: 6

Lesson: 7

Lesson: 8

Lesson: 9

Lesson: 10

Lesson: 11

Lesson: 12

Lesson: 13

Lesson: 14

Lesson: 15

Lesson: 16

Lesson: 17

Lesson: 18

Lesson: 19

Lesson: 20

Lesson: 21

Lesson: 22

Lesson: 23

Lesson: 24

Lesson: 25

Lesson: 26

Lesson: 27

Lesson: 28

Lesson: 29

Lesson: 30

Lesson: 31

Lesson: 32

Lesson: 33

Lesson: 34

Lesson: 35

Lesson: 36

Lesson: 37

Lesson: 38

Lesson: 39

Lesson: 40

Lesson: 41

Lesson: 42

Lesson: 43

Lesson: 44